March 27, 2023

Jose C. Corcione

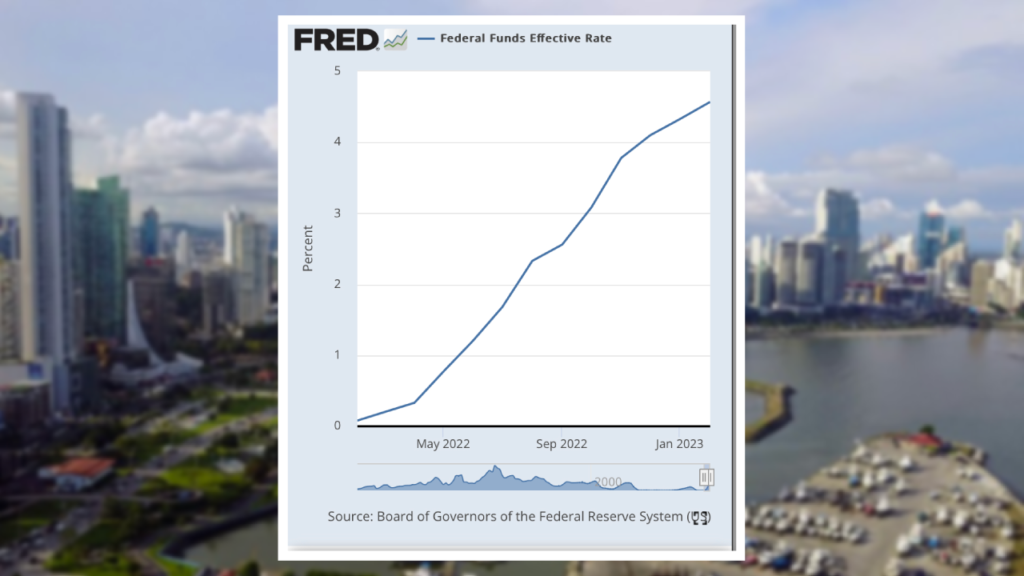

The sudden increase in interest rates in the United States is causing negative effects in dollarized, open economies where the post-COVID19 economic recovery has not been like that of the United States, which is the case of Panama. Ex. Unemployment rate in US 3.5% vs unemployment rate in Panama 10.5%. Rising interest rates imply that the cost of funds for banks is increasing due to competition for deposits. On the other hand, having a hit economy, banks cannot pass this rate increase on to their borrowing clients in the same proportion since it increases their probability of defaulting on their obligations. The FED rate went from 0.5% in 3/2022 to 4.75% in 3/2023. Please see graph.

Today, companies and people have Income Statements still negatively affected by the pandemic and Inflation. An increase in interest expense directly affects these Income Statements of companies and people. The debtor, whose loan rate is raised, requires more cash flow to cover this expense. This generates a greater probability of defaulting on your loan notes.

In banks, this has two impacts. There is the possible deterioration of the assets in your books (loans) and the impact on your Income Statement where your profitability will be reduced due to a possible contraction between the passive and active rate. In other words, banks are forced to raise deposit rates, but due to the deterioration of the companies, they cannot raise loan rates in the same proportion. For example, in 2020, banks took deposits at 1.5% and lent at 6%. % = Margin of 4.5%.

Today they take deposits at 3.5% and lend at 7.0%, Margin of 3.5%. reduction for the bank of 22% (4.5% vs 3.5%). On the client's side, the depositor benefits with an increase of 100% (1.5% vs. 3.5%), but the debtor company that borrowed has an additional cost in the interest category of 17% (6% vs. 7% ).

As we see, this sudden increase in rates, coupled with a Panamanian economy in recovery, impacts the bank's Income Statement due to a reduction in the gross margin and consequently lower Net Profit and/or with a possible deterioration in its portfolio. of assets that generate that income (Loans) that could require greater reserves and consequently lower Net Profit.