August 30, 2021

Jose C. Corcione

Panama is a small country that imports most of the products it consumes. As an open economy, it is subject to what happens in the rest of the world. So the question: Is Panama at risk of inflation?

Many times inflation is associated with periods of economic boom. This is more of a type of inflation derived from demand or economic boom. But in countries like Panama, it is also subject to “imported” inflation when the dollar prices of the products they consume tend to rise. What happened to us when the barrel of oil was at $120/Barrel

The price of Oil has gone from in the last 12 months to; $38/ Barrel to $68/ Barrel. This in turn has pushed up the prices of many other materials. This also raises the price of gasoline, which in turn raises all prices in the logistics chain of consumer goods.

In the construction industry, The price of steel has gone from $800/ton before the pandemic to $1,500/ton after the pandemic. Likewise, many other construction materials. Most of us Panamanians have not felt it, because the construction industry is in a recession and because there is an excess of housing inventory. However, once the economy reactivates, costs will adjust upwards.

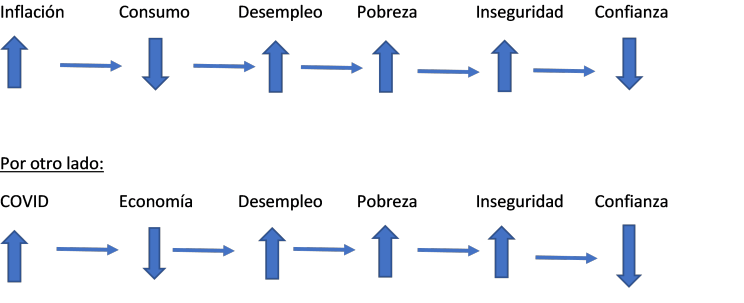

All of this translates into a loss of purchasing power on the part of Panamanians (impoverishment), at a time when, in itself, there are conditions that have reduced the economic activity, employment and well-being of many Panamanians. So, we have the risk of “THE PERFECT STORM”- COVID that has affected economic activity and in turn is also impacted by Inflation.

What can we do?

Here is where the government can provide significant support. As the government injects a perspective of leadership, confidence, stability, legal security, and budgetary execution, it can help the private sector thrive lean on that leadership and inject “push” and “desire to do” new ventures in Panama.